Content

Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser.

In those few dry sentences, however, lurks a powerful tool that financial artists can put to work. Let’s assume our company buys a $36,000 truck in the first full month of operation and expects the truck to last three years, so we depreciate it at $1,000 a month (using a simple straight-line depreciation approach). Alternatively, they might assume the truck will last only one year, in which case they have to depreciate it at $3,000 a month. That one decision might move a start-up company from a profit to a loss. In contrast, cash-basis accounting would record the expense once the cash changes hands from between the parties involved in the transaction. At the month of December 2016, the salesman could earn 2,000$, but the payment of the commission will be payable in January of the following year. Based on Matching principle, Cost of Goods Sold should record in the period in which the revenues are earned.

Difference Between Accounting Costs & Accounting Profit

Just a few of the metrics Baremetrics monitors are MRR, ARR, LTV, the total number of customers, total expenses, and Quick Ratio. Then, in Year 2, the inventory will show a decrease while the accounts receivable shows an increase from the sale.

The income statement shows the product costs that the account managers match to the revenue and the period costs of the current period. So, it means that the matching principle directly affects the net profit or loss. Well, the costs and expenses a company reports are not necessarily the ones it wrote checks for during that period. The costs and expenses on the income statement are those it incurred in generating the sales recorded during that time period. Accountants call this the matching principle—the appropriate costs should be matched to all the sales for the period represented in the income statement—and it’s the key to understanding how profit is determined. In cash basis, a company recognizes the revenues and expenses when it pays or gets cash. On the other hand, the accrual basis and matching principle sound similar and one often use them interchangeably in the accounting world.

Matching Principle: Definition

Because, under the matching concept, the recognition of revenue triggers the recognition of the related expenses, this can have serious effects on a company’s financial statements. Application of matching principle require exercise of judgment especially related to probable cash flows in which case estimation is sometimes required. While estimating, conservatism concept greatly helps management to report fairly on incomes and expenses of the period by not overstating or understanding incomes and expenses. For example, if expenses are not recorded until payment is made, then it may case understatement of expenses in one period and overstatement of expenses in the next. The matching principle requires that a company tie revenue it generates during a given period — say a month, quarter or fiscal year — with expenses it incurred to reap that revenue.

Firms incur floorspace rental expense, over time, only as they occupy the space. For instance, a firm may sign a one-year rental contract for floor space. The agreement, moreover, may call for monthly rent payments due on the first day of each month. Having a system that can automatically segment your customers and report your revenue over specified periods makes these concepts a breeze to follow. Debitoor has aimed to make matching as simple as possible by automating the process. By subscribing to one of our larger plans you can upload a bank statement that will then match each payment to the corresponding invoice or expense.

Challenges With The Matching Principle

In procurement, the matching concept follows a similar path, except it provides a cause and effect connection between a purchase order, its corresponding invoice, and any receiving paperwork related to the transaction. Financial Intelligence takes you through all the financial statements and financial jargon giving you the confidence to understand what it all means and why it matters.

Revenue Recognition Definition (Accounting Principle) – Investopedia

Revenue Recognition Definition (Accounting Principle).

Posted: Sat, 25 Mar 2017 21:04:29 GMT [source]

Curious to know if you’re allocating your expenses correctly in your accounting file? The automated report will tell you how healthy your accounting file is and give you suggestions to improve your score. First, the two transactions occurred over three years in reality, but both are used in the same middle year for the income statement . In the first case, you have more cash on hand than your company has actually earned. In the second case, you have less cash on hand than you have earned, and you might not even receive all the money you have earned. Your company offers a discount to clients that pay their bill annually instead of monthly. They are distinct from product expenses, which are related to products.

What Are The Benefits Of Matching Principle?

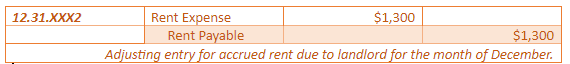

It is fairly basic, at least from a technical standpoint, but it forms the basis for many other more complex rules and practices. The accrual accounting method, for example, is based on this principle since it records financial transactions as they occur, rather than when cash changes hands. Accountants also use it when posting journal entries, as each entry must contain a debit and a credit. In accounting, adjusting entries are completed at the end of the accounting period to update the accounts for internal business transactions. Adjusting entries are commonly used to effect the matching of revenues and expenses. For example, the amount of materials used during a particular accounting period would be recorded by an adjusting entry at the end of each period.

- This is the addition of $5,000 already paid and the $3,000 that are still in payables and will be paid out on the 15th of next month.

- The materiality conceptThis idea is the principle in financial reporting that companies disregard matters are and disclose all essential data.

- Administrative salaries, for example, cannot be matched to any specific revenue stream.

- Free AccessFinancial Modeling ProUse the financial model to help everyone understand exactly where your cost and benefit figures come from.

- In a case like this, there are two classifications it could be categorized under.

An item appearing in current year’s income statement should better appear in last year’s income statement or be deferred to the following yer. The accountants should therefore make their best efforts to apply the concept in its true spirit. Matching principle dictates that entity must recognize expenses in the same period in which it has recognized incomes as earned. If you’re a business owner, revenue recognition and the matching principle are subjects to heed because they go a long way toward computing how much your company makes over time.

Basic Elements Of Expense Recognition

Similarly, the contract which is to be carried out on Jan 2nd is a future date event. However, the contract was received on Dec 23rd, and cash was paid as well on this date. QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans and an intuitive interface. This will require two initial journal entries in the month of January, followed by a recurring journal entry for February through December.

- At the start of the year entity had 1000 units at hand @ 30/unit and bought another 10,000 during the year @ 40/unit.

- Provide a foundation for process automation and optimization that can be readily applied to accounts payable, accounts receivable, and other areas.

- And presents a more accurate picture of a company’s operations on the income statement.

- It becomes very difficult to track the revenue that comes because of the marketing campaign.

- Only public companies are required to use the accrual accounting method.

These metrics are useful for this purpose because they take an investment view of the cash flow stream that follows from an investment or action. The firm reports earning $600,000 in revenues for the quarter just finished, even though some of this is still “payable.” The purpose of the matchingconcept is to avoid misstating earnings for a period. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces.

Matching Concept Examples For Saas Accounting

If any goods have been sold in a particular period, the first test is to ensure that they have been delivered or otherwise placed at the disposal of the buyer. If we include any revenue in a particular period, we should be sure of two key facts. He received another contract on Dec 23rd to be carried out on Jan 5th, for which the client paid him $1,500 in advance. John hired two helpers who are directly employed by his company at the rate of $4,000/person/month as on Dec 21st. If the organization has $100,000 in deals in September, the organization will pay the commission of $20,000 next October.

How realization and matching principle is applied to revenue and expense?

The matching principle requires that expenses incurred to produce revenue must be deducted from revenue earned in an accounting period to derive net income. … The matching principle also requires that estimates be made, based on experience and economic conditions, for the purpose of providing for doubtful accounts.

In the month of January, Jim’s business had sales of $9,000, which means that Jim owes his salespeople $900 in commissions for January. Understanding how the matching principle works is much easier with a few concrete examples. Let’s take a closer look at some from both accounting and procurement.

The matching principle allows an asset to be distributed and matched over the course of its useful life in order to balance the cost over a period. The principle is at the core of the accrual basis of accounting and adjusting entries. The matching principle is based on the cause and effect relationship.

- Application of matching principle require exercise of judgment especially related to probable cash flows in which case estimation is sometimes required.

- John has started with a window washing services business on Dec 18th by investing his own equity of $10,000.

- Thus, the machine is depreciated over its 10-year useful life instead of being fully expensed in 2015.

- Another example would be a singular Internet or television advertisement broadcast during a major sporting or entertainment event.

- This comparison will give the net profit or loss for that particular accounting period.

- Each dollar or unit of currency spent must have an offset, such as wages paid or items purchased for the business.

Get clear, concise answers to common business and software questions. Product Reviews Unbiased, expert reviews on the best software and banking products for your business.

Accrued InterestAccrued Interest is the unsettled interest amount which is either earned by the company or which is payable by the company within the same accounting matching principle period. Depreciation matches the cost of purchasing fixed assets with revenues generated by them by spreading such costs over their expected life.